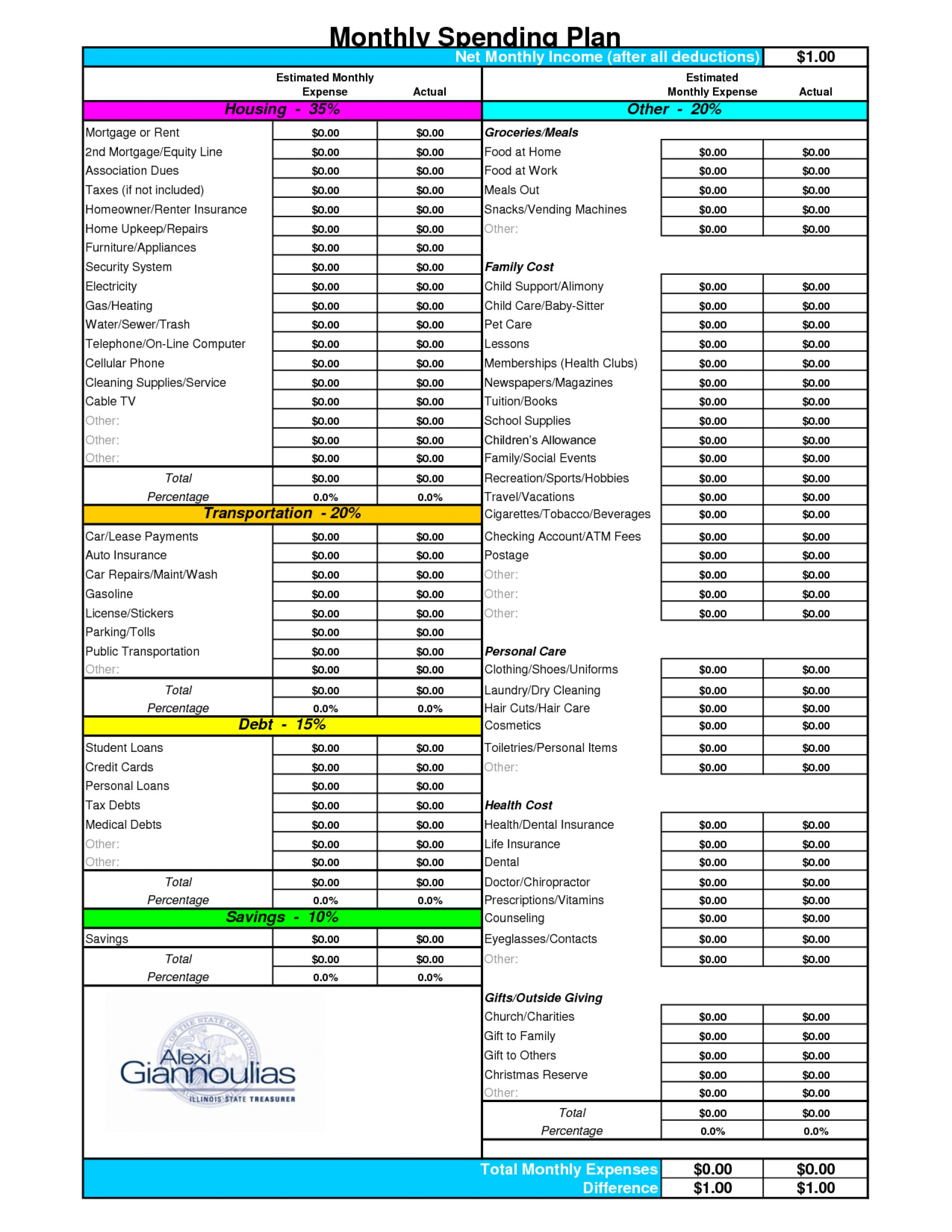

Think of your budget as a strict but kind friend. Try to discipline yourself not to go over your budget. When you spend money, put it in the "Actual" column for that month. Keeping track of your expenses is very important! A thousand or two in repairs every year can be cheaper than buying a new car. A trip that will cost you $50 in fuel actually costs about $100 due to wearing out your tyres, engine, transmission, etc and reducing the value of the car generally.Īlso keeping an old car running can save money if it does not cost too much in fuel and repairs. Owning and running a car is a big expense that you can look at closely.Ī rough rule of thumb is to take the cost of fuel and double it. If your house is far from work, rent it out (to someone reliable!) and use that money to rent a place near work.

#Monthly personal budget install#

Do you own your own house? Install solar to save on electricity.Relocate closer to work to save transport costs.If you have high credit card interest, shop around for better rates.Get quotes for replacing your insurance policies.Cut back monthly subscriptions, do you really all of them?.Review your smart phone and home phone plans.

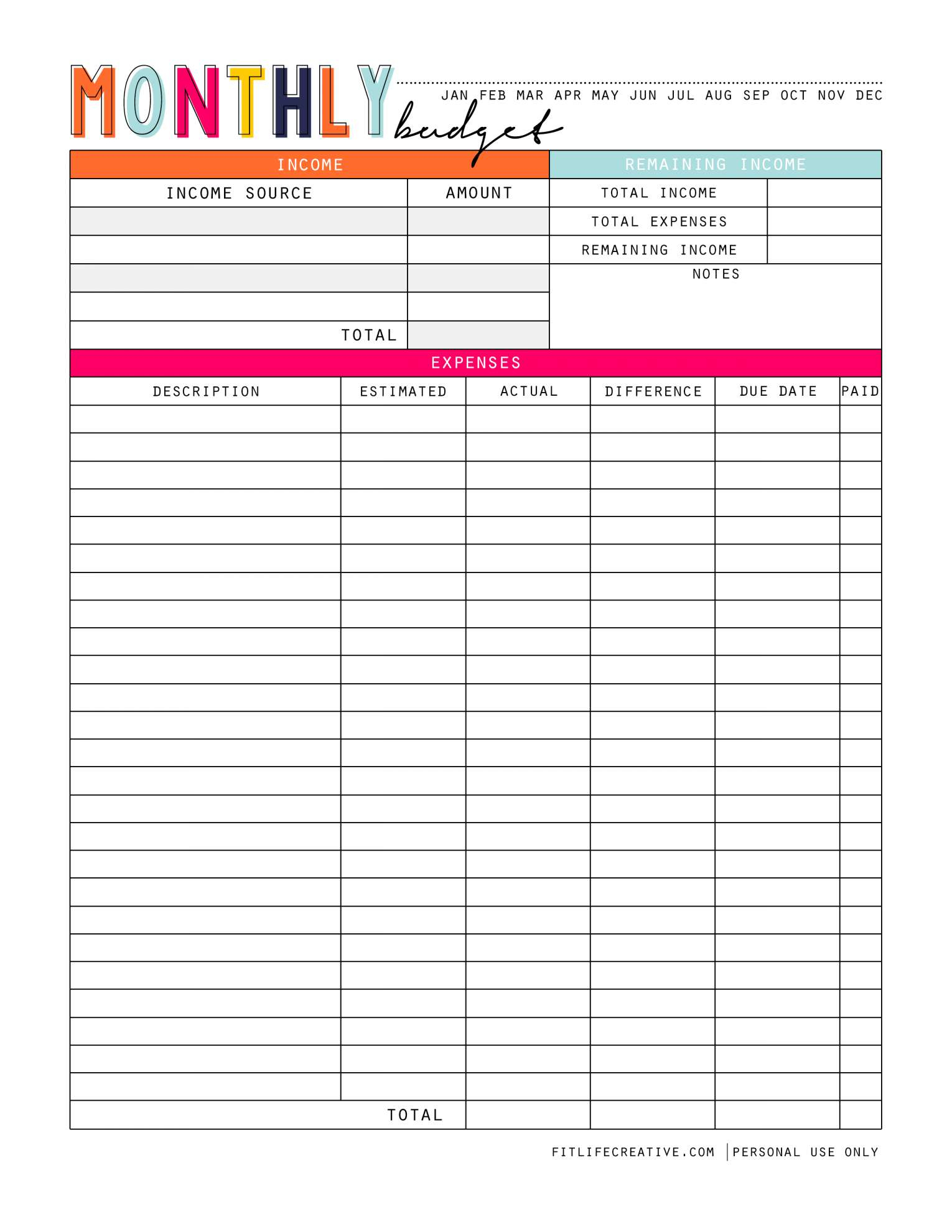

That is OK, it is part of your learning experience. Expenses are going to come along that you didn't think of. Now do totals, put in your income and find what is left each month:Īlso, your first budget may not be very realistic. in short any need or want that is not monthly: Then include budgets for Christmas, birthdays, expenses that come up yearly or quarterly. Budget for the Whole Yearįirst copy your single month to every month of the year: How did you go? You might need to cut your amounts back a little. Your Turn: Complete your list of wants and needs, and compare it to your income, hopefully there is some left too.

0 kommentar(er)

0 kommentar(er)